Introduction to Cashback and Receipt Apps

In recent years, cashback and receipt apps have gained significant traction among consumers looking to enhance their savings on everyday purchases. These innovative applications allow users to receive cash back on a variety of transactions, making shopping both rewarding and budget-friendly. The primary purpose of such apps is to provide consumers with financial incentives to shop at particular retailers or for specific products. By leveraging digital platforms, these apps create seamless opportunities for users to maximize their savings.

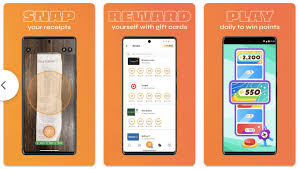

The operation of cashback and receipt apps typically involves a simple process. Users register for an account, browse through available offers, and make purchases either in-store or online. Afterward, they can submit receipts or link their purchase accounts to the app, enabling automated cash back tracking. As a result, users can effortlessly earn money back with minimal effort, which encourages shopping habits that prioritize savings. This ease of use has contributed significantly to their growing popularity.

Moreover, the benefits of utilizing cashback apps extend beyond just monetary savings. They enable consumers to monitor their spending habits, thus promoting a more budget-conscious lifestyle. Many users appreciate the insights provided by these apps, which often include transaction histories and spending analytics. By adopting these tools, shoppers can make informed decisions, identifying which products or stores offer the best cash-back opportunities. With the popularity of e-commerce and the increasing number of offers available online, cashback and receipt apps are quickly becoming essential tools for the savvy shopper. In today’s economic climate, maximizing savings through these apps is not just advantageous; it has become a necessity for many individuals striving to maintain financial health.

How Cashback Apps Work

Cashback apps have gained considerable popularity as a means for consumers to optimize their spending while shopping. The mechanics behind these applications are quite straightforward and user-friendly, attracting a broad audience looking to save money. The typical process begins with users registering for an account on the cashback app of their choice. This registration often involves providing basic personal information and linking a form of payment, such as a bank account or credit card, to facilitate transactions.

Once signed up, users can browse various cashback offers presented within the app. These offers often include a variety of retailers and products, allowing users to select deals that align with their shopping habits. Users earn cash back by making purchases through the app, which tracks the transaction and automatically awards the corresponding cashback. The cash back is generally a percentage of the total purchase amount, but some apps also feature bonus offers that provide a fixed amount for completing specific tasks or purchases.

To further enhance savings, many cashback apps allow users to submit receipts for purchases made outside the app’s platform. This feature is particularly beneficial for users wishing to maximize savings at stores or for products not directly linked with the cashback app. After completing their shopping, users can simply take a picture of their receipt, upload it to the app, and verify their purchase. Once validated, the app rewards users with additional cash back, effective for purchases made outside their usual shopping behavior.

In summary, the efficacy of cashback apps lies in their user-friendly design, diverse offer ranges, and the ability to earn cash back through multi-channel purchases. With these features, users can easily integrate cashback earning opportunities into their regular shopping routines, leading to significant savings over time.

Benefits of Using Cashback Apps

In recent years, cashback apps have gained significant traction among consumers who are looking to make the most of their everyday purchases. One of the primary advantages of utilizing cashback apps is the ease with which users can save money on their transactions. These applications allow individuals to receive a percentage of their spending back as cash rewards, making them an attractive option for both budget-conscious shoppers and those looking to enhance their overall savings strategy.

Another compelling benefit of cashback apps is the promotional bonuses often offered to new users. Many platforms incentivize sign-ups by providing immediate cashback on initial purchases or introducing referral programs that reward users for inviting friends and family. These promotions can lead to substantial savings, especially when paired with strategic shopping, such as during sales events or holiday seasons. Furthermore, cashback apps may provide access to various deals and discounts that are not available through traditional credit or debit card transactions, thereby maximizing the rewards for loyal users.

Additionally, cashback applications often come equipped with features designed to assist users in budgeting and financial management. By tracking spending habits and categorizing purchases, these apps can help individuals gain a better understanding of their financial behaviors. This insight can be invaluable for developing more effective budgeting strategies and making informed decisions about future spending. As users become more aware of their financial situations and begin to see their savings accumulate, the motivation to manage finances responsibly often increases.

In essence, the benefits of utilizing cashback apps extend far beyond mere savings; they encompass promotional opportunities and enhanced financial awareness, making them an essential tool for today’s savvy consumer.

Top 10 Cashback Apps Reviewed

In recent years, cashback apps have surged in popularity, providing users with opportunities to earn rewards for everyday purchases. Below is a curated list of the top 10 cashback apps available in 2023, each offering unique features and advantages.

1. Rakuten – Rakuten offers one of the highest cashback rates among major retailers. Users can earn money back on purchases made through the app or website. With a user-friendly interface and both in-store and online options, Rakuten is popular among shoppers. However, payouts can take time, which may deter some users.

2. Ibotta – Ibotta allows users to earn cashback on grocery shopping through a straightforward process. By scanning receipts and verifying purchases, users can quickly accumulate rewards. While its limited selection of stores can be a drawback, its bonuses for specific products enhance its appeal.

3. Dosh – Dosh stands out for its automatic cashback feature, which links to user credit or debit cards. Once linked, cashback is earned without manually submitting receipts. This seamless experience is a major advantage, although its network of participating businesses may not be as extensive as some competitors.

4. Fetch Rewards – Fetch Rewards is unique in its emphasis on receipt scanning. Users earn points for simply scanning grocery receipts, which can be redeemed for gift cards. While the app does not offer direct cashback, its user-friendly platform and ease of use make it a favorite.

5. Swagbucks – Swagbucks combines cashback with various earning opportunities, such as surveys and shopping. Users can accumulate Swagbucks points redeemable for cashback or gift cards. Although the app can sometimes be overwhelming due to the myriad of options, it remains a popular choice for its flexibility.

6. Honey – Acquired by PayPal, Honey integrates a browsing extension that automatically applies coupon codes for extra savings during online shopping. It also has a cashback reward system, making it versatile. However, users may find that not all merchants participate in the cashback feature.

7. Shopkick – Shopkick rewards users for both online and in-store shopping experiences. Users can earn “kicks” for scanning products, making purchases, or simply walking into stores. The variety of earning options is a highlight, although the app’s interface may be confusing for new users.

8. GetUpside – Focused primarily on fuel purchases, GetUpside helps users save on gas by providing cashback through linked transactions. As the app primarily targets gas stations, its applicability may be narrower than other options, but it remains a practical choice for frequent drivers.

9. MyPoints – MyPoints rewards users for shopping through their platform, similar to Swagbucks. Additionally, it offers rewards for taking surveys and other online activities. Its versatility is a plus, but navigation can be less intuitive compared to other cashback apps.

10. Groupon – While primarily known for discounts, Groupon offers cashback through certain deals, allowing users to save on experiences and products. Its vast selection is beneficial; however, users must remain vigilant about the expiration dates on deals.

Each of these cashback apps presents distinct features, enabling users to find solutions that best fit their shopping habits. By carefully evaluating options, consumers can optimize their savings effectively.

How to Choose the Right Cashback App for You

Selecting the ideal cashback app requires careful consideration of various factors that align with your shopping habits and personal preferences. Begin by examining the user interface and overall experience of the app. A straightforward and intuitive design is paramount to ensuring that you can easily navigate through the app and access its features without frustration. A good user experience will enhance your engagement and make utilizing the cashback features more enjoyable.

Next, look into the range of stores and products that the app partners with. Not all cashback apps offer the same opportunities for savings; some may focus on specific retail sectors, such as groceries or online shopping, while others may provide broader coverage. Choose an app that includes stores where you frequently shop, as this maximizes your potential to earn cashback on routine purchases.

Cashback rates play a pivotal role in your choice as well. Different apps offer varying percentages, and certain categories may deliver higher rates than others. To identify the most advantageous option, consider comparing the cashback rates provided by different applications across your favorite retailers. This will help you identify where you can benefit the most financially.

Withdrawal options are another critical aspect to think about. Some apps may offer immediate transfers to your bank account, while others could involve a waiting period or minimum withdrawal thresholds. Determine which withdrawal method aligns with your preferences and financial needs. This will ensure that you can access your earned cashback promptly when you choose to.

Lastly, it is essential to evaluate your spending habits. Consider what types of products you frequently purchase and the frequency of your shopping trips. By understanding your spending patterns, you can select an app that caters to your lifestyle, ultimately enabling you to maximize your savings effectively.

Smart Shopping Tips to Maximize Cashback Returns

Maximizing cashback returns through apps requires a strategic approach. One of the most effective strategies is to stack cashback offers with credit card rewards. Many credit cards offer cashback on specific purchases or in specific categories, aligning these rewards with your cashback app purchases can amplify your savings. For instance, using a credit card that provides an additional percentage back on grocery shopping while simultaneously utilizing a cashback app designed for grocery purchases can enhance your overall return.

Timing of purchases is another crucial factor. Many cashback apps and retailers offer promotional periods where they provide increased cashback rates on certain products or categories. Staying informed about these time-limited promotions allows users to plan their shopping trips accordingly. For example, if a cashback app indicates a higher percentage for select items during a promotional event, it is beneficial to wait and make purchases during that specific time frame to maximize savings.

Combining app offers with store sales can further boost cashback returns. Retailers often run sales on popular products, and when these sales align with cashback offers available in various apps, it creates a robust opportunity for shoppers. Consider checking apps for available coupons or cashback incentives before making in-store purchases, ensuring that you leverage every available opportunity.

Additionally, signing up for email newsletters from both retailers and cashback apps can keep you in the loop regarding exclusive promotions, discounts, and limited-time offers. Many stores incentivize their newsletter subscribers with additional cashback rates or offers that are not available to the general public.

By employing these smart shopping tips, users can enhance their experience with cashback apps and ultimately increase their savings. Thoughtful planning and a keen eye for offers play a vital role in utilizing these digital tools effectively.

Common Mistakes to Avoid When Using Cashback Apps

As cashback apps continue to gain popularity among consumers looking to maximize their savings, it becomes essential to navigate these applications effectively. While they offer numerous benefits, users can easily fall into certain traps that may hinder their overall experience and reduce their potential savings. One significant error is overlooking the terms and conditions associated with each app. Many consumers hastily sign up without thoroughly reading the fine print, which can lead to misunderstandings about cashback rates, eligible purchases, or withdrawal requirements. Understanding these details is crucial to fully benefit from cashback opportunities.

Another common pitfall involves missing deadlines for receipt submissions. Each app typically has specific time frames within which users must upload their purchase receipts to qualify for cashback. Failure to comply with these deadlines means forfeiting potential savings, rendering the effort futile. It is wise for users to set reminders or maintain a consistent schedule for submitting receipts to avoid this issue. Staying organized not only helps maximize refunds but also fosters a habit of tracking spending more consciously.

Finally, users often neglect to verify the cashback received from their transactions. After submitting a receipt or making a purchase, it is crucial to check back and confirm that the expected cashback has been correctly credited to their accounts. This step is vital, as discrepancies can occur. If a user notices an inconsistency, addressing it promptly with the app’s support team can help recover forfeited savings. Paying attention to these common mistakes can enhance the overall experience with cashback apps, ensuring that users are making the most of the financial benefits available to them.

Alternatives to Cashback Apps: Receipt Scanning and More

While cashback apps have gained immense popularity for providing direct financial benefits on everyday purchases, they are not the only avenues available for consumers to enhance their savings. Receipt scanning apps and loyalty programs present viable alternatives that can yield significant rewards. Understanding these options can help consumers maximize their savings potential.

Receipt scanning apps operate on a straightforward principle. Users need to scan or upload images of their receipts from various grocery stores, retail outlets, and restaurants. Upon submission, these apps convert the receipts into digital form and analyze the details. Users are then rewarded based on the processed receipts, often earning points or cash back. This method not only offers an additional layer of savings but also allows users to track their spending habits more efficiently. Popular examples of these apps include Fetch Rewards and Ibotta, which enable users to turn ordinary grocery purchases into rewards.

Loyalty programs, on the other hand, are frequently offered by retailers and brands, incentivizing customers to shop frequently at specific establishments. By enrolling in these programs, consumers can earn points on their purchases, which can later be redeemed for discounts, exclusive offers, or free products. Many grocery chains, clothing retailers, and even gas stations offer such loyalty rewards. Significantly, these programs occasionally combine with receipt scanning applications, enriching the user’s reward potential. For instance, users might earn points from a loyalty program and then receive additional bonuses from a receipt scanning app when they register their purchases.

Ultimately, exploring these alternatives can expand the range of options for consumers seeking to optimize their savings strategies. Receipt scanning apps and loyalty programs not only complement traditional cashback apps but also empower users to achieve greater financial benefits through their everyday spending.

Conclusion: Making Every Purchase Count

In the modern financial landscape, consumers are increasingly seeking ways to enhance their savings and make informed purchasing decisions. The previously discussed cashback and receipt apps serve as invaluable tools in attaining these goals. By leveraging such applications, individuals can effectively harness the potential for significant monetary returns from their everyday spending.

Cashback apps are designed to reward users for their purchases, allowing them to earn a percentage of their spending back. This incentive not only encourages responsible consumer behavior but also fosters a proactive approach to personal finance. Receipt scanning applications further complement this strategy by encouraging users to submit their shopping receipts for rebates and rewards, transforming ordinary shopping transactions into opportunities for savings.

It is essential to emphasize that the benefits of utilizing cashback and receipt apps extend beyond mere financial gains. These applications also promote awareness of purchasing habits, enabling users to make better spending choices. For instance, tracking spending patterns can motivate consumers to avoid unnecessary purchases, ultimately leading to enhanced financial wellbeing. Furthermore, many of these tools offer various promotions and bonuses that can amplify the savings experience.

As consumers consider the various options available, it’s evident that integrating cashback and receipt applications into their financial routines can yield fruitful results. By embracing this technology, individuals can maximize their savings potential, allowing them to make strategic financial choices. Therefore, utilizing these apps is not merely a trend, but a conscientious decision to improve one’s financial stability, ensuring that every purchase counts towards long-term savings goals.